The 7 Biggest Global Diamond Suppliers and Traders

Diamonds are a hugely valued resource all around the world, with the global diamond mining market size valued at an estimated USD 551.9 billion in 2022. Mining companies operating in almost every continent employ thousands, who cut open rocks deep underground to search for these rare and beautiful stones. The diamonds are then valued, sorted and shipped by diamond dealers to reach jewellers all over the world, where they are polished, set into jewellery and sold to consumers.

What Countries Produce the Most Diamonds?

In years gone by, diamonds were considered extremely rare, but this all changed when South Africa, the Democratic Republic of Congo and Botswana discovered enormous deposits that were previously unknown. Now, diamonds are produced on a huge scale each year.

As of January 2022, there are estimated to be 1.3 billion carats of diamonds in industrial diamond reserves worldwide. Most of these (600 million carats) are in Russia, with Botswana and the DRC holding the second and third-highest reserves.

However, having high reserves of diamonds does not necessarily mean a country produces a lot of diamonds. This depends on the efficacy of mining operations and diamond dealers in getting the diamonds to market. So which countries produce the most diamonds?

Russia has been a leading nation in diamond production since 2009, producing 30.5% of the world’s gem-quality diamonds. Most of Russia’s diamond deposits are in the Siberian region of Yakutia. Russia produced 30.1m carats in 2021.

The Republic of Botswana is the second-largest producer of diamonds. After discovering diamond deposits in 1966, the country was a pioneer in bulk sampling within diamond mining. By excavating large amounts of kimberlite, the host rock for diamonds, and sampling them to understand how the diamonds are spread out, Botswanian mining companies identified diamond ‘pipes’ or seams across a large area. In 2019, Botswana had the fastest growth rate in diamond production among the top 10 diamond-producing countries in the world, at 6%, and their diamonds currently hold the highest market value. In 2021, they produced 22.9m carats. Companies operating in the Republic of Botswana include De Beers, Petra Diamonds, Lucara Diamonds, Gem Diamonds and Firestone Diamonds.

Canada is the youngest diamond producer on the list, with diamond deposits in the Arctic circle providing new seams to follow. In 2021, Canadian diamond mines in Diavik, Ekati and Gahcho Kue, Quebec and Ontario produced 17.6m carats of gem-quality diamonds. Companies operating in Canada include Rio Tinto, Dominion Diamond, De Beers and Stornoway Diamonds.

The Democratic Republic of Congo has long been one of the world’s most significant diamond producers, and despite production difficulties in recent years they remain in the top five producers in the world as of 2021, producing 14.1m carats.

South Africa is known for revolutionising the modern diamond industry, producing 9.7m carats in 2021, and the only known home of pink and blue diamonds. The large deposits have been rapidly depleted, however, and South Africa mainly mines in alluvial deposits, on the coasts of rivers and the seabed along the west coast.

What Companies Are The Biggest Diamond Suppliers in 2023?

The global diamond market is dominated by just a few companies, with mines on multiple continents. Diamond companies may perform many different roles within the market, including mining, sorting and grading, polishing and cutting, wholesale cut diamond supply and retail jewellers. The ranking of the biggest suppliers by carats produced changes year to year but is more stable when measured by revenue.

7 Biggest Diamond Suppliers by Annual Revenue

The biggest names in Diamonds are mainly mining operations, and some are state-owned or state subsidised while others are private enterprises. Here are the seven diamond companies with the highest revenue in 2022 (USD).

Rio Tinto – $55.6 billion

An Anglo-Australian multinational company, Rio Tinto Group was founded in 1873 by Scottish industrialist, Hugh Matheson of Matheson & Co. along with engineers Clark, Punchard & Co. The Rio Tinto company is named after the river in Huelva, Spain, which is the site of the mining complex they bought from the Spanish government at the outset of the company. By innovating mining techniques, they quickly grew and today they extract, process and distribute iron, copper, aluminium, lithium and uranium as well as diamonds. Their diamond trading spans three continents, operating mines in Canada, Australia and Zimbabwe. Together, these mines account for 20% of global diamond production annually.

Anglo-American – $35.1 billion

A multinational mining company overseen by headquarters in London, Anglo-American was founded in 1917 by South African Sir Ernest Oppenheimer. The naming of the company is due to its initial funding from American and UK banks. Anglo-American mines various minerals, including diamonds, copper, platinum and iron. Many of these are used for mobile chips and smartphone parts, but their stake in the diamond industry is considerable. Anglo-American are majority shareholders in De Beers, another leading diamond miner, and established Boart International, a company which mines low-grade diamonds for industrial tooling.

ALROSA – $4.5 billion

Russia’s state-operated diamond miner, ALROSA, usually accounts for 30% of global rough diamond production. Due to the war in Ukraine, the UK and US imposed sanctions in early 2022, so they may no longer be top of the list when ranked by diamond production.

In 1954, the Soviet Union discovered diamond ore deposits and authorised mining activities in 1957 by a company now owned by ALROSA. The conglomerate was established in 1992 through a presidential decree, specifically for mining, manufacturing and distributing diamonds worldwide, and is now responsible for 94% of Russia’s total diamond production. ALROSA has operations in Angola in Africa and is set to expand into Zimbabwe, where 22 diamond deposits were recently discovered.

De Beers – $6.6 billion

De Beers was founded in 1888 by Cecil Rhodes, the colonial politician and businessman. The company mined initially in South Africa but today operates in 35 countries, mining, trading, retailing and manufacturing diamonds through multiple subsidiaries. The mines are mainly in Australia, Botswana, South Africa, Canada and Namibia. When ranked by the value of the diamonds they have extracted, De Beers group is the world’s largest diamond producer.

Debswana Diamond – $4.6 billion

A joint venture by De Beers and the Botswanian government, Debswana was founded in 1969 after rough diamond deposits were discovered in Orapa. As well as this location, Debswana runs mines in Jwaneng, Damtshaa and Letlhakane, contributing greatly to Botswana’s economic growth. The Botswanian government owns and controls equal shares with De Beers because no private mining activity is permitted in the country. Botswanian diamonds currently hold the highest market value, bringing huge economic benefits to Botswana.

Okavango – $1.1 billion

Another Botswanaian enterprise, Okavango was established in 2012 by the government in Botswana. Okavango is most famous for mining a nearly flawless 20.64-carat diamond called the Okavango Blue Diamond, but their speciality is trading rough diamonds. This places them well in light of rising prices for rough diamonds.

Arctic Canadian Diamond Company – estimated $627 million

Finally, the Arctic Canadian Diamond Company Ltd. was founded on 19th April 1994, under Aber Resources Ltd, after geologists discovered diamonds in Diavik. The Diavik Diamond Mine was established that same year. Now with many mines in multiple locations, the company has increased its revenue rapidly without compromising on ethical sourcing. Their mine in Ekati has been praised on the global stage for its Environmental, Social and Governance performance, having shown initiative and leadership in protecting and preserving the environment and establishing good community relations during exploration or mining operations.

The Largest Diamond Mining Companies Ranked By Rough Diamond Production 2021

ALROSA – 32.4 million carats

De Beers – 32.3 million carats

Debswana Diamond – 23 million carats

Arctic Canadian – 4.5 million est.

Rio Tinto – 3.8 million carats

Ethically-Sourced Diamonds & Diamond Cutters

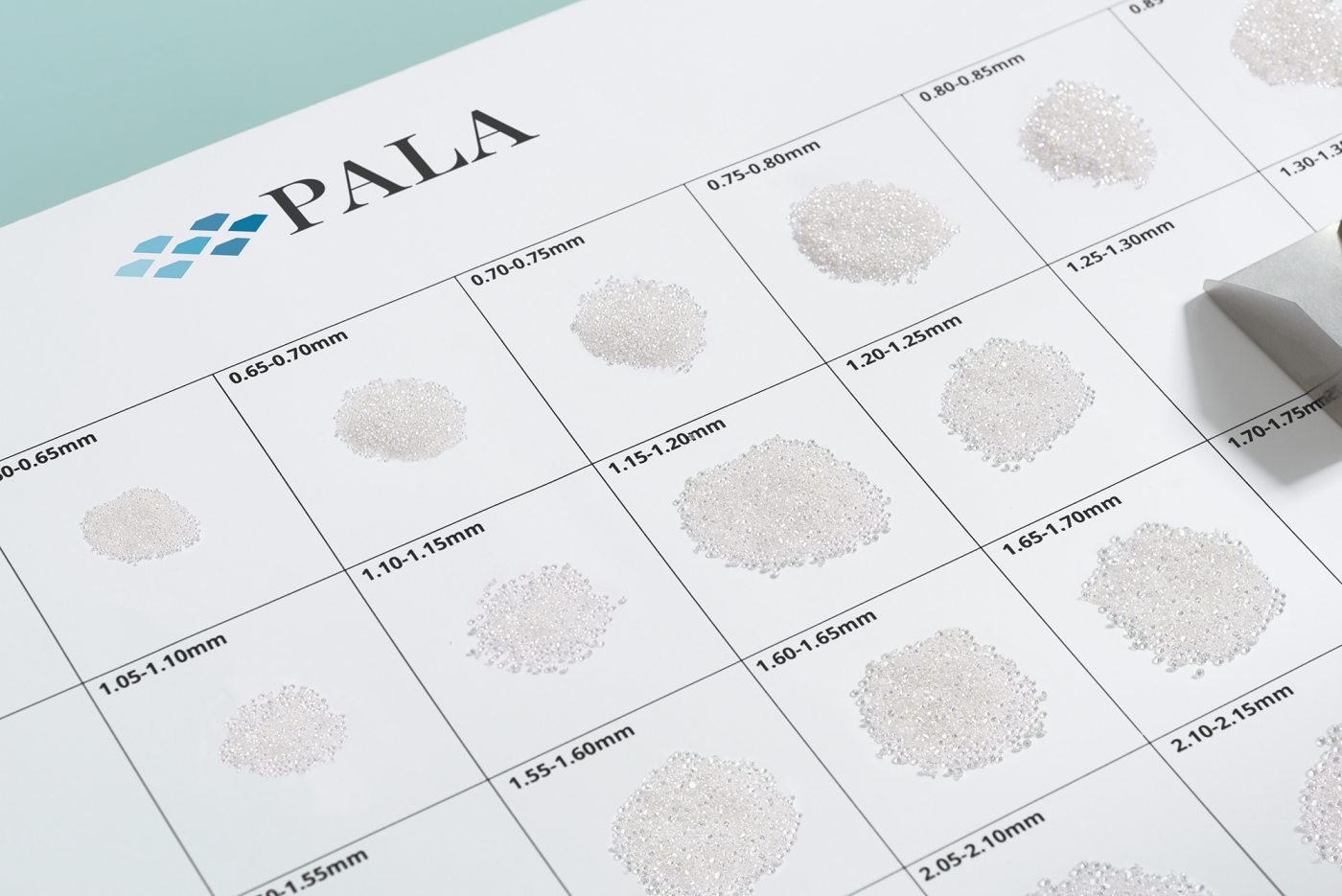

At Pala Diamonds, we sit at the pivot between mining companies and jewellers. We pay particular attention to the provenance of our diamonds and strive for transparency throughout the industry. It is well-known that some mining operations use rough diamonds to finance conflict, harming adjacent communities. By adopting stringent procurement standards such as those set out by the Kimberley Process Certification Scheme and the Responsible Jewellery Council, we can guarantee that our diamonds are not linked to any conflict, exploitation or human rights violation. We hope to influence the supply chain and encourage transparency of diamond provenance by 2030.